As our Slot Trumps research endeavors advance into the third global igaming market, we continue to amass intricate details about player preferences across different landscapes. Having studied some of the most rapidly growing regulated and newly regulating environments, a pattern begins to emerge, painting a vivid picture of international online gaming behavior.

Romania, which is divided between aficionados of classic slots and Bonus Buyers, contrasted sharply with Brazil’s ‘thrillseekers’, has now been set side by side with Greece—the first market where our analyses have clearly shown regulatory shifts shaping online casino play.

The year 2022 marked a turning point for the Greek online gaming sphere. The government raised the maximum stakes on slot games from the 2020 limit of €2 to a reprised cap of €20. Additionally, the jackpot ceiling for games of chance and slots swelled from €70,000 to a robust €140,000. Notably, the slots’ spin speed was also quickened, dropping from a three-second interval to just two seconds.

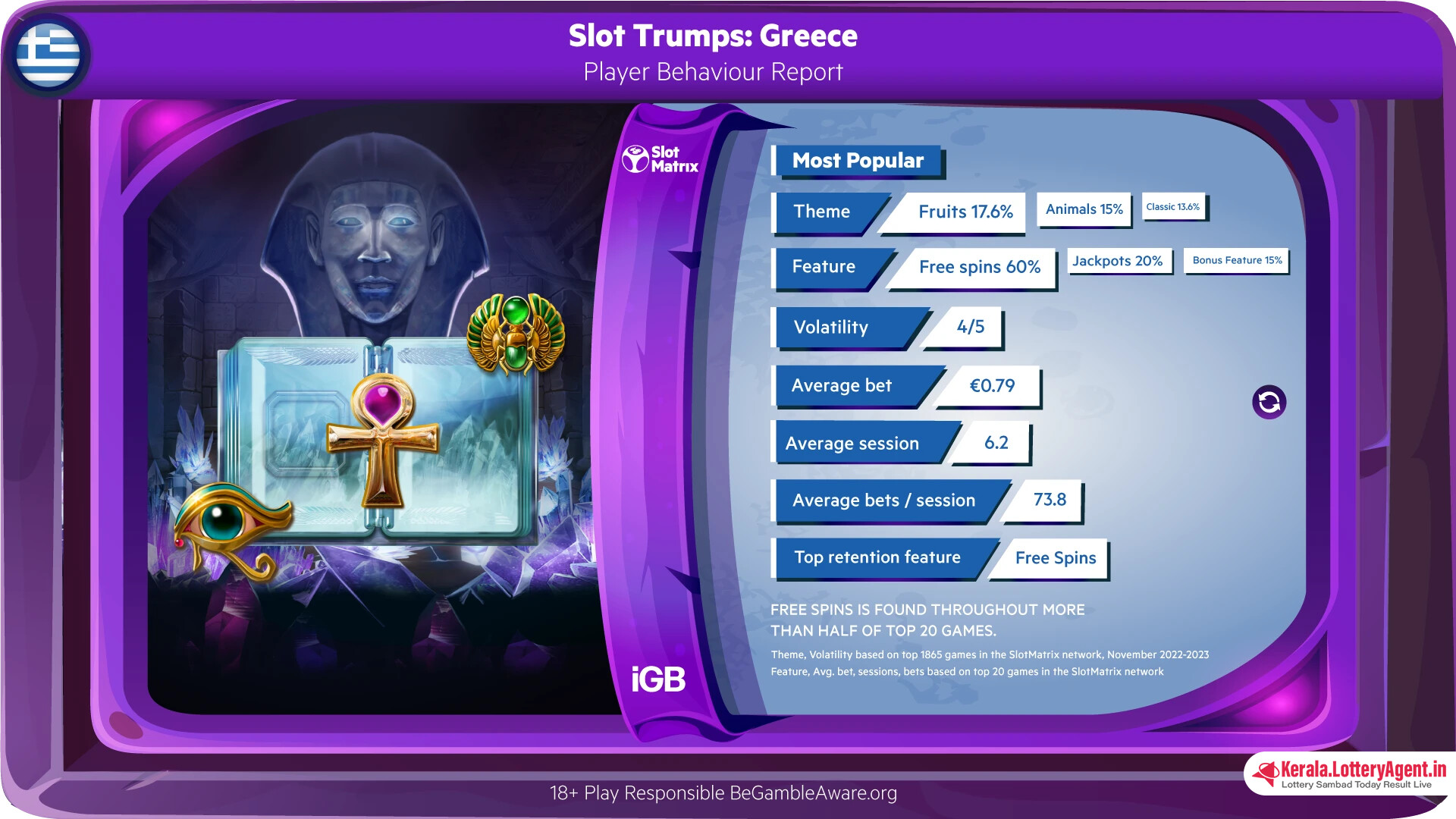

Despite a discernible improvement in conditions for both players and the industry, the regulatory framework continues to significantly influence player behavior in Greece, as evidenced by our findings. For instance, ‘Buy features’ remain out of bounds for the Greek gamers. The maximum bet cap inevitably affects in-game bonus facilities along with stake levels averaging at €0.79 per spin. A mere fifth of the most engaged 20 games have an average bet surpassing €1.

Greek players have taken these regulations in stride, where traditional game mechanics triumph over their modern counterparts. In the statistics gathered within the SlotMatrix Greece network, an impressive 60% of top 20 games integrate Free Spins. By comparison, only 20% of these games carry jackpot options, and a scant 15% have bespoke bonus features facilitating direct bonus round access.

Taking a broader view, players in Romania are observed to invest three times more per spin in their top-tier games (averaging €2.59). Here, the regulatory reins are significantly looser. In the burgeoning market of Brazil, even amidst evolving gaming legislations, the spend per spin sits higher than in Greece, at €1.09 on average.

Yet, these figures only partially disclose the immense interest in real-money gaming within Greece—a country with a smaller adult population than Romania or Brazil. This is further exemplified by the average session metrics within a 90-day period: 6.2 sessions, 459 bets per player, and 73.8 bets per session, drawn from SlotMatrix’s consolidated top games.

Greece manages to project a strong gaming presence despite the regulatory limitations that prevent players from indulging in certain facets available in other jurisdictions. The latest national figures underscore this sentiment, displaying gross gaming revenues (GGR) hiking up by 16% year-over-year to €619 million, and a 4% increase in the third-quarter GGR alone, which ascended to €212 million.

Pettersen delves into the strategic intricacies that operators can deploy to consistently captivate the Greek gaming demographic against a backdrop of shifting regulations. In markets akin to Greece, compliance and an in-depth understanding of the regulatory landscape emerge as imperative.

The CasinoEngine productivity platform embodies this notion by offering operators dominion over the gameplay window across devices. It accords real-time compliance notifications, time and wagering limits, authenticity verifications, and custom reporting. It includes a toolbar allowing toggles for money transfers and mode switching between actual gameplay and demonstration.

Brands also gain the option of overlaying the gameplay window with additional features, such as quick deposit access and cashier functions, game information, and engaging gamification elements.

Operators reap the benefits of precise, real-time reporting once a game is underway with CasinoEngine’s feedback tools, which include detailed session data like notification intervals and user profiles.

To thrive in the Greek market, an adequately tailored and personalized content strategy is essential, given the distinctive regulatory mandates and cultural predilections of its players. Adapting to the Greek market’s evolving conditions is critical for effective lobby management and game localization. This means adopting a highly flexible and proficient aggregation platform is not just beneficial, it’s crucial.

SlotMatrix empowers brands to opt for content that resonates with each market, guided by a productivity platform that fosters flexibility and personalization. Consequently, operators can hone in on player segments and instantly present them with their preferred gaming experiences, adding new content of relevance in a timely manner.

Furthermore, brands can deftly maneuver what various players see, crafting multiple lobby variations and configuring game sequences to fit specific markets or player preferences with utmost precision.

For operators aiming to flourish in Greece’s online casino segment, aligning with a solid foundation inclusive of the right tools and features is paramount.

For a more detailed exploration of Greek player and betting tendencies, reference our latest Slot Trumps Player Behaviour Report.

Meet our team at ICE 2024 for insights tailored to the EveryMatrix platform by booking a meeting now!