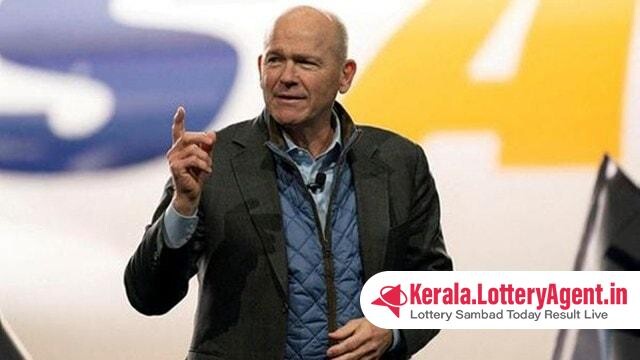

Amid tumultuous times for Boeing, CEO David Calhoun has found himself at the crossroads of public scrutiny and corporate responsibility. Having helmed the aviation giant’s endeavors last year, Calhoun received compensation valued at a staggering $33 million, with the majority issued in the form of stock awards. However, in light of recent events adversely affecting the company’s stock, Calhoun’s stock payout for the impending year is anticipated to see a reduction of nearly one-fourth.

The root of this financial recalibration stems from an incident on January 5, wherein a Boeing 737 Max jet operated by Alaska Airlines suffered a significant malfunction. A door-plug panel detached from the jetliner as it cruised at an altitude of approximately 16,000 feet over Oregon. This episode has since attracted intense scrutiny, prompting the Federal Aviation Administration, the National Transportation Safety Board, and the Justice Department to initiate separate probes into Boeing’s operational integrity.

In a move perhaps indicative of a leader assuming accountability or an acknowledgment of the challenges ahead, Calhoun voluntarily renounced a bonus for 2023 estimated to be nearly $3 million. This forfeited bonus was revealed in conjunction with an announcement earlier this month declaring that Calhoun would vacate his position as CEO by the end of the year – a decision coming amidst an onslaught of investigations scrutinizing the quality and safety of Boeing’s manufacturing processes.

A regulatory filing provided detailed figures regarding Calhoun’s earnings, illuminating that his salary for the prior year stood at $1.4 million, bolstered significantly by stock awards valued at $30.2 million. This brought his total compensation up to $32.8 million, marking an escalation from the $22.6 million he received in the preceding year.

The outlook for Boeing has been somewhat clouded by persistent fluctuations in its share price, precipitated not only by the January mishap but by broader concerns about the aircraft manufacturer’s oversight of product safety and quality control. This adds a layer of complexity to an already charged situation for the company, historically regarded as a titan within the aerospace sector.

Calhoun, who took the reins as CEO at a particularly challenging time for Boeing, has faced his fair share of hurdles over the last few years. From dealing with the fallout of two fatal crashes involving the 737 Max which led to a worldwide grounding of the fleet, to overseeing its return to service amidst the global pandemic, Calhoun’s tenure has been anything but smooth sailing.

Despite the pressures, Calhoun has spearheaded efforts to steer the company back towards stability, focusing on restoring trust among the public and regulatory bodies, and reshaping the corporate culture that many have blamed for Boeing’s woes. His efforts aim to cement a legacy of reform and recovery rather than the scandals that have tarnished Boeing’s reputation in recent times.

Investors and industry experts alike are closely watching the company’s next moves, weighing the potential of Boeing’s comeback against the weight of its recent missteps. With Calhoun’s departure set for the year’s end, the speculation is rife about the direction and leadership that will follow during this crucial juncture for the aerospace behemoth.

As Boeing treads through the tempest of these challenges, the path ahead is laden with the daunting task of rebuilding its image and securing its place in the future of aviation. However, this latest development – a CEO’s remuneration package clipped by share price realities and bonus refusal – may signal the beginning of a renewed era of accountability and cautious optimism for one of America’s most storied industrial giants.