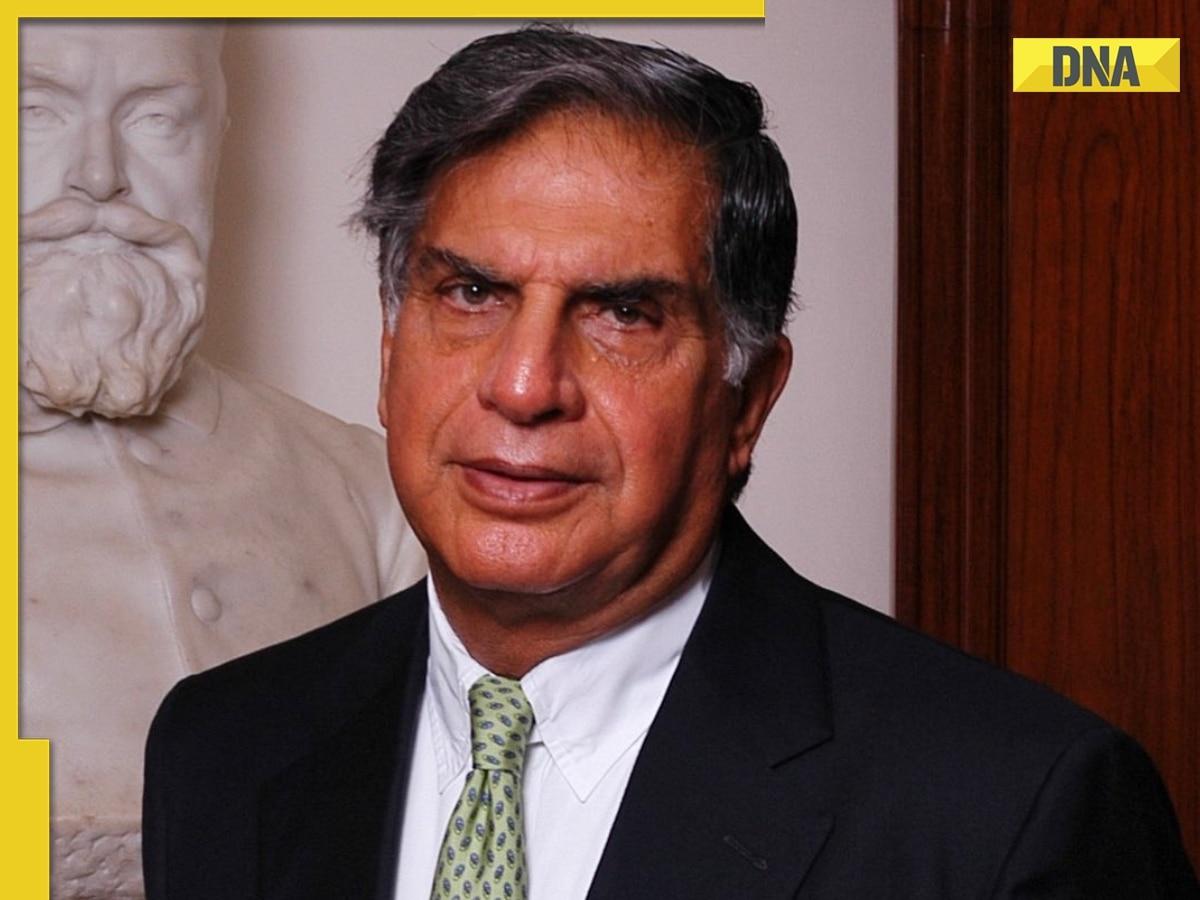

Esteemed industrialist, renowned philanthropist, and the transformative ex-chairperson of Tata Sons, Ratan Tata, witnessed a precipitous decline in his company’s shares earlier this week. For over two decades, from 1991 to 2012, Tata helmed the Tata Group, leading its ascent to global prominence. His relentless dedication saw the conglomerate’s revenue multiply dramatically. Post-retirement, the venerable 86-year-old was bestowed the title of Chairman Emeritus across several branches of the conglomerate, including Tata Sons, Tata Industries, Tata Motors, Tata Steel, and Tata Chemicals, recognizing his enduring legacy.

However, this Monday marked a stark turn of events as Tata Motors’ shares nosedived over 8%, causing consternation among investors. The disquieting performance in the March quarter did not meet market expectations, resulting in the stock plummeting 8.34% to close at Rs 959.80 on the National Stock Exchange (NSE). In a worrying trend throughout the day, the shares nosed down even further, hitting a low of Rs 948, a 9.44% drop from its opening price. Consequently, a staggering Rs 29,016.23 crore was erased from Tata Motors’ market valuation, bringing it down to Rs 3,19,012.47 crore and earning the dubious distinction of being the most significant underperformer among the firms listed on both the Bombay Stock Exchange (BSE) Sensex and the NSE Nifty.

In stark contrast to its stock performance, Tata Motors had only recently announced a more than three-fold surge in its consolidated net profit at Rs 17,528.59 crore for the quarter ending in March 2024. This remarkable uptick in profits was attributed to impressive performances across all three of its auto business domains, particularly its British division, Jaguar Land Rover, which made notable strides.

The reported net profit stands in stark comparison to that of the same quarter in the previous year, wherein the company had posted a consolidated net profit of Rs 5,496.04 crore, as per the figures disclosed in Tata Motors’ regulatory filing. During this quarter, the total consolidated revenue from operations was also significantly higher, totaling Rs 1,19,986.31 crore, a considerable increase from the Rs 1,05,932.35 crore reported in the year-ago period. The last quarter of the fiscal year proved fruitful as each automotive division within Tata Motors contributed to this robust performance.

As investors digest these mixed signals, with strong financial results paradoxically accompanied by a troubling share price performance, the long-term implications on Tata Motors’ market position remain to be seen. The company, part of the sprawling Tata conglomerate with interests ranging from salt to software, has been a vital player in India’s industrial expansion and global outreach.

The Tata motors’ episode is a reminder that even established giants are not immune to the volatile whims of the market. Undoubtedly, the market’s reaction to quarterly earnings is multifaceted, encompassing not just the historical data but also the forward-looking projections, industry trends, and broader economic indicators that could sway investor confidence.

As the financial realm continues to monitor Tata Motors’ trajectory, the comprehensive interpretations of their quarterly reports and their reflection on the company’s strategy will remain a topic of considerable interest. Ultimately, the company’s ability to navigate through the ebbs and flows of market pressures and uphold its commitment to innovation and growth will be the truest test of the legacy that Ratan Tata has built.

(With inputs from Press Trust of India)