In a significant development in the gaming industry, Penn Entertainment (NASDAQ: PENN) saw its stock rise by 4.22% midday Friday following news of a potential acquisition bid involving Flutter Entertainment and Boyd Gaming. Meanwhile, Flutter’s stock remained stable after a brief morning uptick, and Boyd Gaming’s shares were also flat following an early rise prompted by the news.

Brendan Bussmann, a well-known gaming consultant, shared his thoughts on the matter with iGB. “Adding Flutter into the equation with Boyd for a potential Penn acquisition makes it more than interesting,” Bussmann noted. “It’s a back door into the ESPN brand for online betting while also providing a brick-and-mortar presence for Flutter.”

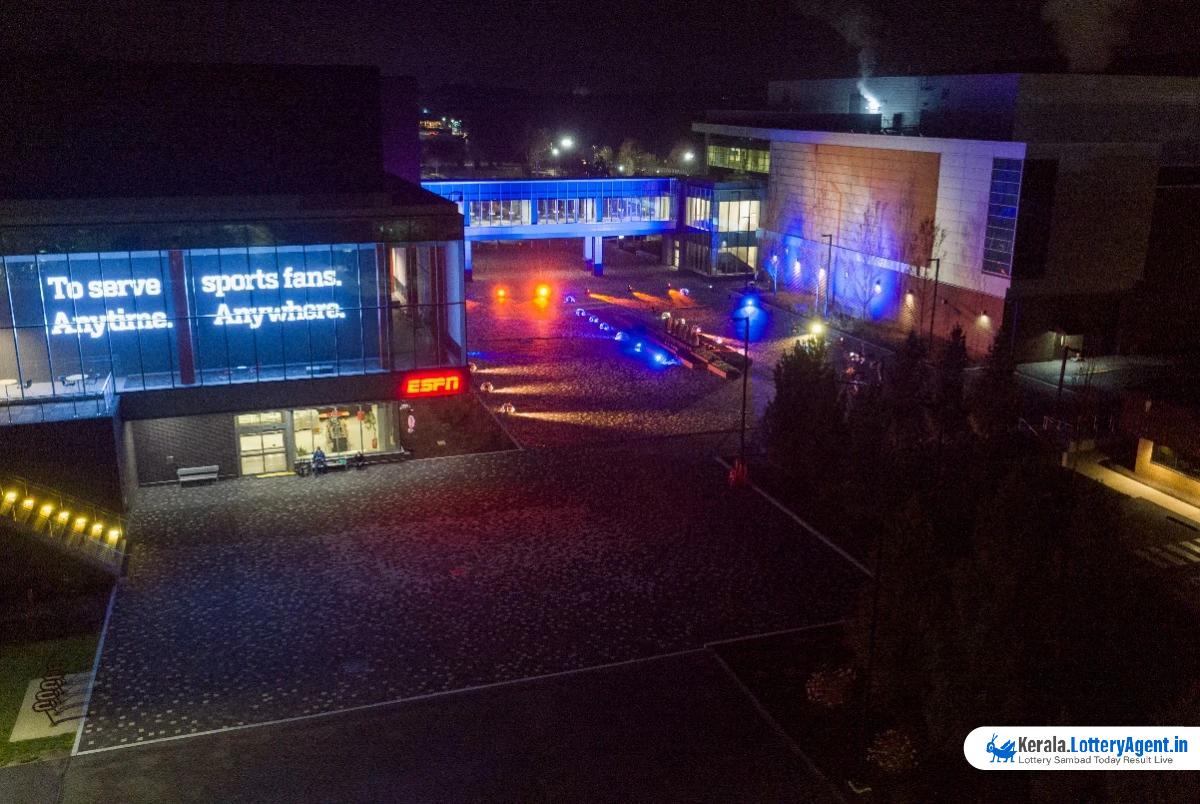

This news followed a report from TheDeal.com that suggested Flutter, the owner of FanDuel, could be interested in partnering with Boyd Gaming to acquire Penn’s interactive assets, which prominently include ESPN Bet. TheDeal.com’s report cited unidentified sources and caught the attention of market analysts and stakeholders alike.

Penn Interactive had launched its ESPN Bet platform on November 14 of the previous year after severing its partnerships with Barstool Sports. ESPN Bet made its initial debut in 17 states, with North Carolina joining in March when its market opened. The rebranded platform aims to capture a significant share of the digital sports betting market in collaboration with the ESPN brand.

Currently, ESPN Bet boasts about a 6% market share in the United States, a number dwarfed by the 80% hold by industry giants DraftKings and FanDuel. Penn also plans to roll out ESPN Bet in New York later this year, following WynnBet’s exit from the state, adding another strategic market to its reach.

Rumors about a potential acquisition began to intensify in late May when the Donerail Group wrote an open letter to Penn’s board.

. The activist investor expressed concerns over a dramatic 80% decline in Penn’s stock over the past three years. The letter highlighted a pattern of missed guidance and continued investments in underperforming interactive projects, which had significantly eroded the credibility of Penn’s management team and board of directors.

In June, Truist Securities also weighed in, declaring Penn’s stock as undervalued with a target share price set between $23 and $25. This was a notable point as Penn’s stock last hovered in that range back in February. Around the same time, Reuters reported that Boyd Gaming had made a takeover bid for Penn, valued at over $9 billion, though several investment banks speculated that Penn might not be interested owing to various challenges.

“The discussion presents several hurdles, especially in states currently dominated by Boyd and Penn properties,” said Bussmann, principal at BGlobal, a Las Vegas-based consultancy. Bussmann pointed to states like Louisiana, Indiana, and Missouri as examples where regulatory and operational challenges could complicate any potential deal. “It’s like trying to solve a jigsaw puzzle. You need to figure out what you need to keep, what you need to shed, and who could be a potential suitor.”

Looking ahead, Boyd Gaming is scheduled to release its second-quarter earnings on July 25, followed by Penn on August 8, and Flutter on August 13. These upcoming earnings reports are anticipated to offer deeper insights into the likelihood and logistics of any potential acquisition deal. It will also reveal where ESPN Bet stands in its quest to expand its digital gaming market share.

While Flutter representatives declined to comment on these latest reports, and Penn had not responded to inquiries as of Friday, the industry is keenly observing these developments. The potential deal underscores the dynamic and ever-evolving landscape of the gaming and sports betting industries.

As stakeholders await further announcements and careful scrutiny of quarterly earnings, the gaming world watches closely to see how these giants will maneuver within an increasingly competitive environment. An acquisition involving Flutter and Boyd could indeed reshape the landscape, introducing new strategies and possibly setting the stage for more complex industry consolidations in the future.