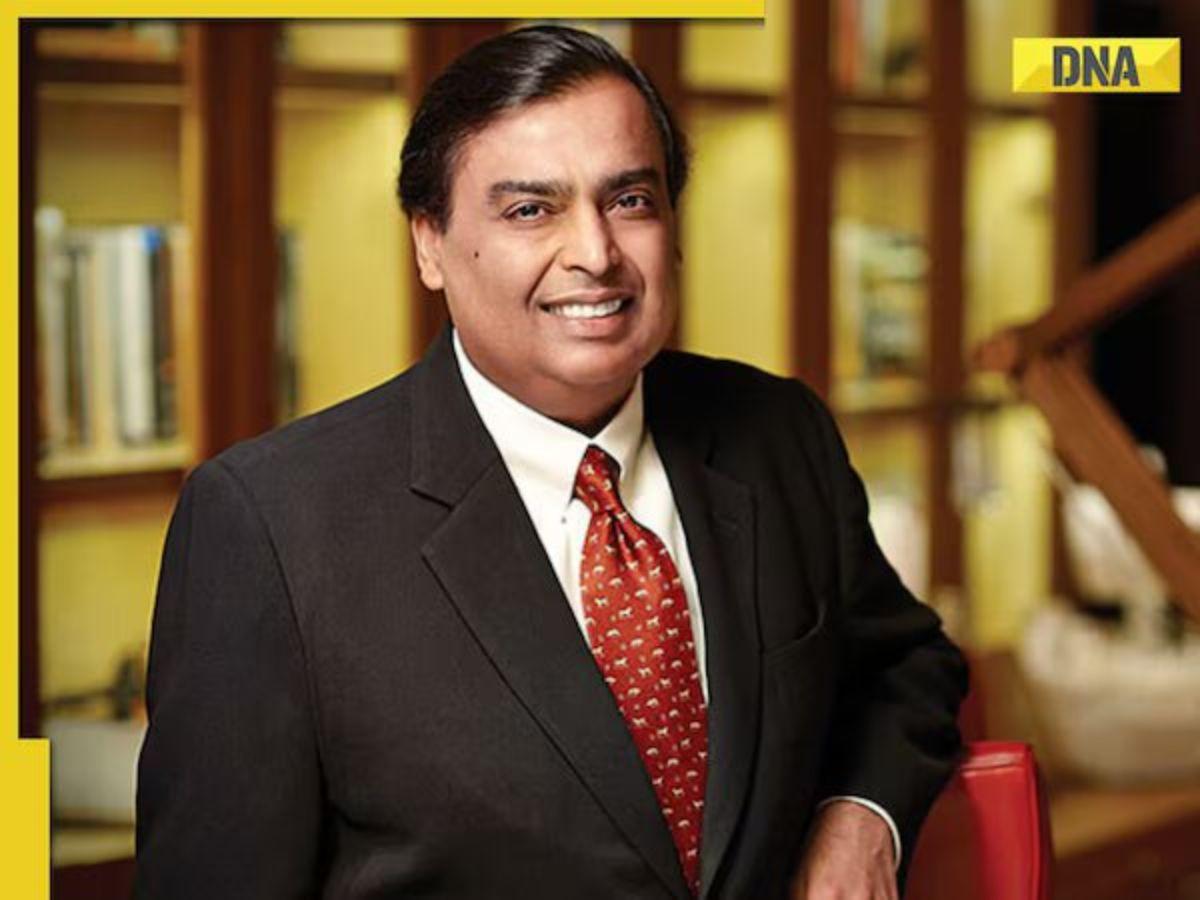

According to the Forbes Real-Time Billionaires List, Mukesh Ambani has been the richest person in the nation for a considerable amount of time. Following a prosperous year, the billionaire joined the elite group of people with a $100 billion net worth at the start of 2024. As of right now, his net worth exceeds Rs 940000 crore.

For those who are not aware, Reliance Jio Infocomm, led by Mukesh Ambani, will likely go public before other companies. The Hindu Businessline reports that Reliance Jio Infocomm is likely to be the first to debut on the public markets. They also stated that Reliance Industries (RIL) is evaluating a possible $100 billion valuation, or more than Rs 830000 crore, at a share price of about Rs 1200. A sizable offer-for-sale (OFS) component will be part of the IPO.

This move symbolizes a significant milestone for Reliance Jio, a company that was founded in 2016. Since its inception, Jio has attracted a massive subscriber base by implementing a competitive pricing strategy. This aggressive market penetration approach has enabled it to disrupt incumbent telecom players and emerge as a dominant force. Originally, Jio had decided against entering the equity markets in 2020 despite securing investments between $57 and $64 billion from 13 foreign investors. These noteworthy investors include Meta, with a 9.9% stake, and Google, with a 7.73% stake, signaling a robust international vote of confidence in the company’s vision and potential.

The report further elaborates that this strategic move towards an IPO is influenced heavily by the need to provide an exit route for private equity and other investors who had poured in more than $20 billion back in 2020.

. These stakeholders are now seeking liquidity options, making an IPO a logical next step. This aspect of the decision emphasizes the dynamic nature of investment and exit strategies in the corporate world, particularly in high-growth sectors like telecommunications and digital services.

Analysts also point to the potential impact of this IPO on the broader market. Given the sheer scale of Reliance Jio Infocomm’s operations and market influence, a successful IPO could set a precedent, influencing public market activities for other unicorn startups and tech firms in India. Furthermore, this move might attract considerable international attention, potentially drawing increased foreign direct investment into the Indian market.

It’s worth noting that Mukesh Ambani’s leadership style and strategic foresight have been pivotal in RIL’s and Jio’s ascension to their current status. Under his stewardship, Reliance has diversified its business interests across various sectors, from oil and retail to telecommunications and digital services. The anticipated IPO of Reliance Jio Infocomm can be seen as a culmination of years of aggressive expansion and innovation.

Besides the financial ramifications, this IPO is likely to have broad socioeconomic impacts. Jio’s services have significantly contributed to increased digital inclusion across India, offering affordable internet access to millions. A successful IPO could mean further investments in technological advancements and infrastructure, potentially benefiting India’s digital economy even further.

In summary, Reliance Jio Infocomm’s planned IPO, with its valuation pegged at over Rs 830000 crore, signifies a monumental event in the Indian corporate sector. With significant stakes from global giants like Meta and Google, the IPO is set to provide an exit for high-profile investors and potentially reshape the public market landscape in India. As Mukesh Ambani continues to fortify his business empire, the world watches closely, anticipating the ripple effects this move will have both within India and globally.