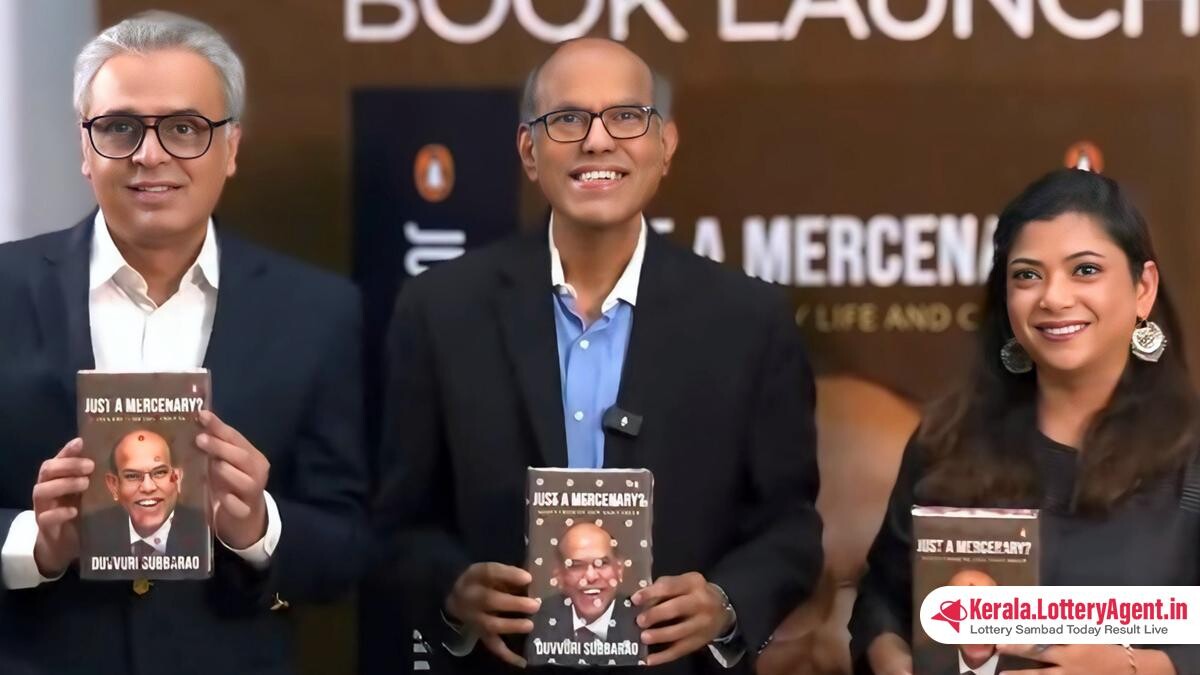

Amidst the grandeur of the book launch event at the Kautilya School of Public Policy, GITAM Deemed to be University, the former Governor of the Reserve Bank of India (RBI), Duvvuri Subbarao, delivered a compelling message about the critical role of central banks in sustaining economic stability. On April 24, Mr. Subbarao presented his experience and insights coinciding with the release of his new book ‘Just A Mercenary? Notes from My Life and Career’, prompting a robust discussion on the intersection of finance and governance.

Highlighted in his address was the imperative separation between political spheres and the pivotal decisions made by a country’s central bank. The former governor emphasized the adverse impact that political influence can have, especially considering politicians operate within the confines of electoral cycles. Their decision-making processes, he suggested, are inherently misaligned with the long-term economic viewpoints requisite for managing inflation and ensuring price stability.

“You can’t leave those decisions to politicians,” argued Mr. Subbarao, citing the need for what is often the painful task of controlling money supply and interest rates as a means to sustain growth over time. These necessary measures, although potentially stunting short-term growth, are designed to protect the broader economic landscape and prevent inflationary spirals.

The philosophical underpinnings that separate the actions of the central bank from governmental agencies, as Mr. Subbarao pointed out, rest on the intention to maintain a degree of insulation from political pressure. This separation, he stated, is crucial for enabling central banks to carry out their mandates effectively. Yet, he acknowledged the inherent tension that exists between governments and monetary authorities, a dynamic that is no stranger to any country, be it Japan, Europe, Turkey, England, or the United States.

Addressing the audience, made up of academics, policymakers, and students, Mr. Subbarao raised concerns regarding the maturity of democratic institutions. He cautioned that while countries like the United States might withstand presidential criticisms of its Federal Reserve without market destabilization, India’s relatively nascent institutions could suffer from similar public conflicts. The ramifications, he warned, would be undesirable market instabilities that underscore the need for a more careful management of the relationship between governments and central banks.

During the event, Mr. Subbarao did not just confine his discussion to the technicalities of central banking but ventured into a personal reflection on his career in the Indian Administrative Service (IAS). He highlighted the importance of civil servants staying connected to the realities on the ground, beyond the reach of technology, and called attention to the significance of gender parity within the civil services. In addition, he advocated for a conduct rule that would instate a mandatory cooling-off period before civil servants could transition into active politics upon their official retirement.

The engaging and insightful dialogue was deftly moderated by journalist and visiting faculty at the Kautilya School of Public Policy, Smita Sharma. With contributions from Dean Syed Akbaruddin and others, the event reflected the convergence of scholarship and practice in public policy discussions.

As the evening concluded, it became abundantly clear that the former RBI governor’s views on banking autonomy and the division of economic powers are not merely theoretical postulations but essential tenets to preserve economic stability in a democracy. His insights advocate for a conducive environment where long-term vision trumps transient political aspirations, encapsulating the perennial challenge of balancing governance with economic expertise.