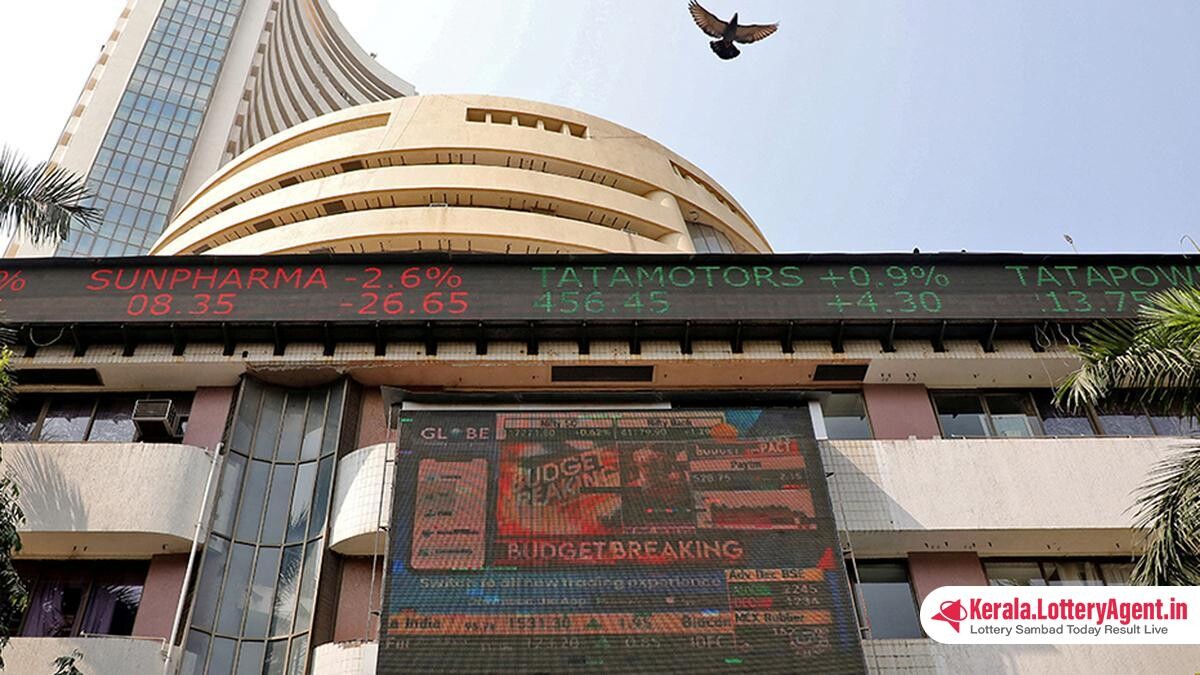

In a remarkable display of bullish strength, the S&P BSE Sensex vaulted past the 75,000 mark on Wednesday, powered by investor enthusiasm in the banking and technology sectors. The Sensex’s upward movement was steady and measured, ending the trading session with a gain of almost half a percent or 354.45 points to reach a closing figure of 75,038.15. While Tuesday’s trading witnessed the Sensex hitting an all-time intraday high at 75,124.28, a subsequent bout of profit booking trimmed those gains, yet the momentum remained positive overall.

The charge was led by stellar performances from index heavyweights, with ITC surging 2.49%, followed closely by gains in Kotak Bank at 2.40%, Bharti Airtel at 2.11%, State Bank at 1.94%, Asian Paint at 1.36%, and Tech Mahindra at 1.24%. These strong gains underscored investors’ robust confidence in the soundness of these corporations and their growth prospects.

Parallel to the Sensex, the National Stock Exchange (NSE) also saw Coal India at the forefront of its gains. The NSE Nifty-50 index paralleled the Sensex’s headway, climbing half a percent to land at 22,753.80, up by 111.05 points.

Market experts weigh in on this extraordinary rally, noting its significance and underlying factors. Ajit Mishra, Sr. VP, Technical Research at Religare Broking Ltd., observed that the ascent of the indices was a continuation of the prevailing upward trend. Mishra pointed out that there was a broad sectoral alignment with the movement, highlighting that FMCG, metal, and energy were among the top gainers. In conjunction, broader indices also surged after a brief pause, climbing in the range of 0.7%-0.9%.

He underscored the impactful nature of rotational buying across various sectors, which, coupled with a stable global economic environment, is propelling the index higher with each progressing day.

Echoing a similar sentiment, Suman Bannerjee, CIO of Hedonova, remarked on the historic milestone reached by the Sensex as it effortlessly scaled beyond the 75,000 level for the very first time. Bannerjee spotlighted the remarkable pace of the recent stock market rally; the Sensex accumulated the last 5,000 points to surge from 70,000 to 75,000 in fewer than 80 sessions, or under four months since it crossed the 70,000 threshold on December 14, 2023.

The rapid growth trajectory of the Indian stock market has been bolstered by a number of solid sectors including capital goods, automobiles, banking, and metals. A noteworthy contributor to the market’s stability has been the increasing involvement of retail investors, according to Bannerjee. These investors have played a pivotal role in cushioning the market against potential crashes, even amidst concerns over the possibility of foreign capital flight in response to the Federal Reserve’s delays or modest rate cut decisions.

The dynamism and resilience of India’s economy reflect in its stock market’s performance. A mixture of domestic factors such as corporate earnings, government policies, and investor sentiment, merged with international currents ranging from global trade agreements to monetary policy shifts, have all dovetailed to guide the Sensex’s historic leap.

With the Sensex etching a new chapter in its history book, the mood among market players is one of cautious optimism. Investors and analysts alike will closely monitor the economic indicators and corporate developments in the weeks to come to discern whether this growth can be sustained in the longer term. The Indian stock market’s future seems bright, but it’s clear that sustaining such growth will need the continued reassurance of sound economic fundamentals and policy backing.