In a display of resilience, stock markets on Thursday witnessed a significant rebound, with the benchmark Sensex closing the day with an appreciable gain of 128 points. This surge was fueled by a powerhouse performance of the Goods and Services Tax (GST) collections for April, which hit an unprecedented record, coupled with optimistic manufacturing data and a fresh wave of foreign fund inflows, all contributing to a buoyant investor sentiment.

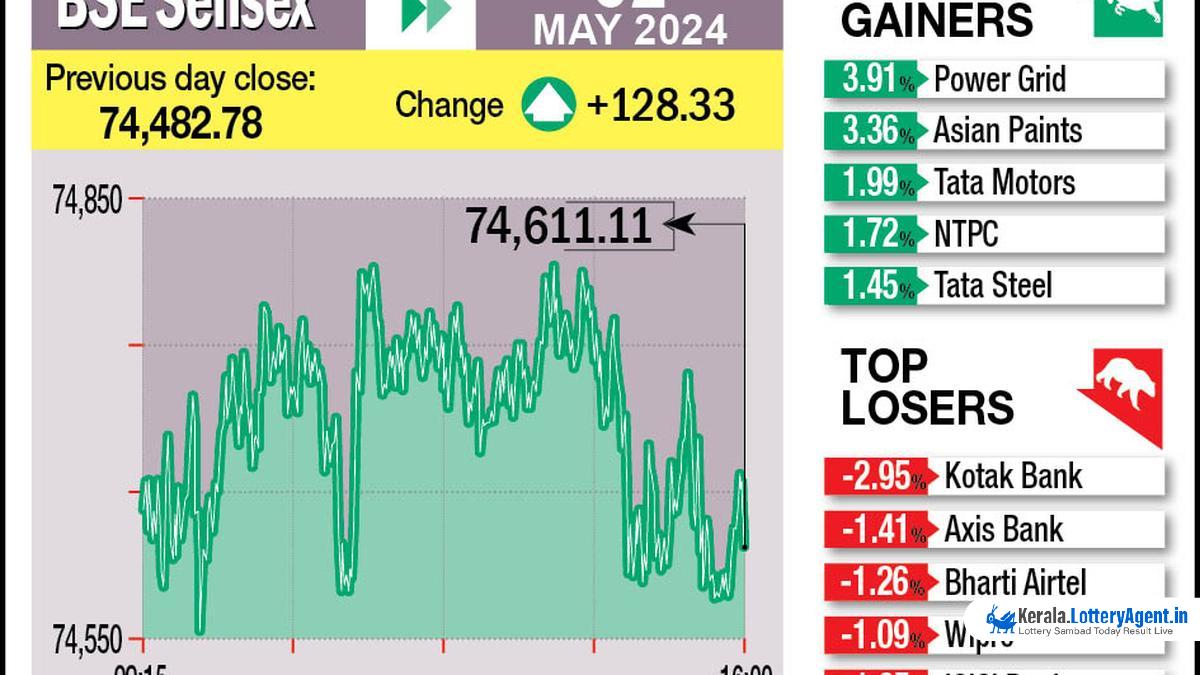

The 30-share BSE Sensex’s ascent by 128.33 points, or 0.17%, to settle at 74,611.11 was noteworthy. The trading day saw it reach even higher, as it soared 329.65 points, or 0.44%, to touch 74,812.43 at its peak. The NSE Nifty too charted positive territory, increasing by 43.35 points or 0.19% to arrive at 22,648.20, mirroring the strength seen in broader markets.

Leading the gains within the Sensex basket were prominent names such as Power Grid, Asian Paints, Tata Motors, Tata Steel, NTPC, Sun Pharma, Mahindra & Mahindra, HDFC Bank, Tata Consultancy Services, and JSW Steel. Not all shares enjoyed the bullish run, however, with Kotak Mahindra Bank, Bharti Airtel, Axis Bank, Wipro, ICICI Bank, and IndusInd Bank finding themselves on the other end of the spectrum.

The stellar performance of the stock markets can in part be attributed to the GST collections which grew a robust 12.4% to a record high of ₹2.10 lakh crore in April. This remarkable feat was supported by strong economic momentum, with increased domestic transactions and imports significantly contributing, as per statements from the finance ministry. For the first time ever, GST collections breached the ₹2 lakh crore mark in April, signaling a major financial milestone for the country.

Moreover, the vigour of the Indian manufacturing sector played a pivotal role in boosting market confidence. Despite a marginal dip, the sector continued to exhibit the second fastest improvement in operating conditions in over three years, backed by surging demand. According to the latest monthly survey, the seasonally adjusted HSBC India Manufacturing Purchasing Managers’ Index (PMI) witnessed a slight drop from 59.1 in March to 58.8 in April. Nevertheless, the PMI reading comfortably indicated expansion, as in the index, a figure above 50 signifies growth while below 50 points to contraction.

Apprehension remained on the global front as Asian markets saw a mix of results, with Hong Kong’s market climbing while those in Seoul, Tokyo, and Shanghai closed lower. In Europe, markets exhibited a mixed demeanor as well. On Wall Street, investors experienced a mixed finish on Wednesday.

Prices of the global oil benchmark Brent crude followed an ascending trajectory, climbing 1.02% to stand at $84.29 a barrel, further indicating vital signs of recovery in the economic sectors leveraging crude oil.

Foreign Institutional Investors (FIIs) brought a positive push to the market, purchasing equities to the tune of ₹1,071.93 crore on Tuesday, as reported by exchange data. It is noteworthy to mention that domestic equity markets observed a closure on Wednesday due to the Maharashtra Day holiday.

Before this resurgence, the BSE benchmark had paused its upward journey, having declined 188.50 points or 0.25% to settle at 74,482.78 on Tuesday, with the NSE Nifty dipping 38.55 points or 0.17% to finish at 22,604.85. Thus, Thursday brought a welcome change in direction for investors and analysts closely observing stock exchange trends.

As the markets settled into this new optimistic rhythm, all eyes remained fixed on the potential of India’s growing economy to sustain these positive indicators in the face of global and domestic challenges.