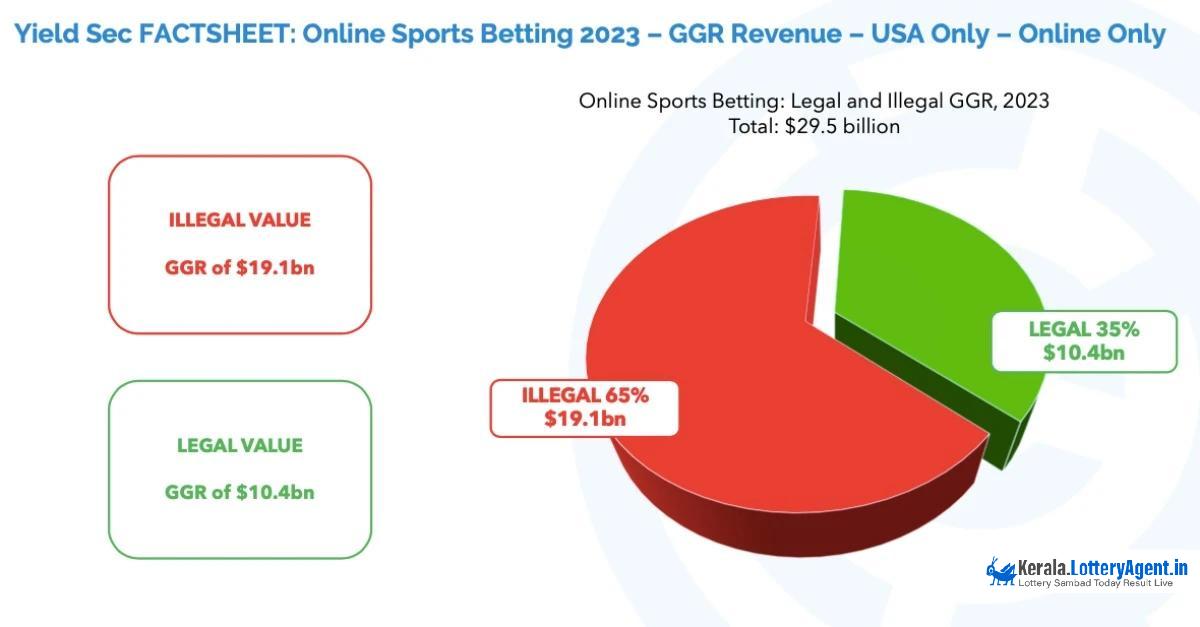

In 2023, the US gambling market saw significant growth, yet challenges remain as illegal operators continue to attract a considerable number of bettors. According to Yield Sec’s latest report, the projected total gross gaming revenue (GGR) amounted to $29.5 billion, with legal operators accounting for $10.4 billion of this sum.

Yield Sec, a market intelligence platform leveraging artificial intelligence to gather and refine gambling-related data, has further broken down these figures. The report reveals that 15% of all legal US GGR came from basketball, 10% from football, and 6% from baseball. Of particular note is the dominance of parlays in US betting, which made up a staggering 54% ($15.9 billion) of the GGR. A company spokesperson explained that while operator data might suggest football is the most-bet sport in the US, many of these wagers are incorporated into parlays, which are categorized separately in Yield Sec’s data.

The comprehensive report, entitled “How America Bets Online,” focuses exclusively on online or digital gambling activities. Yield Sec’s innovative approach involves using AI to scour the internet for gambling-related keywords, refining the collected data, and then applying machine learning techniques to predict illegal market trends based on legal market figures.

However, the report did not provide a breakdown of bets on the black market. What it did emphasize is the ongoing prevalence of illegal betting. “Throughout 2023, our monitoring has shown the dominant influence of illegal betting and gaming operators on American audiences across social media platforms, search engines, and the broader ‘online conversation,'” wrote Yield Sec researchers. “During certain sporting events, as much as 80% of social media posts linking to betting content were in favor of illegal operators.”

The dominance of illegal operators was even more pronounced in social video content related to betting, with up to 85% of all video material featuring overt branding for illegal operators. Yield Sec researchers noted that social media and online platforms are instrumental in spreading illegal gambling content, often bypassing the more stringent regulations that legal operators face.

Yield Sec emphasized that their predictions regarding the black market are speculative but pointed to their track record of accurately predicting legal market scenarios as validation of their analytical methods. For example, the company claims to have predicted the GGR for the 2024 Super Bowl with approximately 3% accuracy.

Interestingly, despite the stubborn persistence of illegal gambling, the report does show a year-over-year decline in black-market activity. The overall US sports betting market exhibited growth, rising from $54.3 billion in GGR in 2022 to $57.

.8 billion in 2023. While legal operators saw an increase in their handle, Yield Sec predicted a contraction in the black market’s share. In 2022, legal operators registered $12.27 billion in GGR compared to an estimated $42.03 billion by illegal operators. By 2023, the legal market share had grown to $16.88 billion, while the predicted illegal market share had decreased by $1.1 billion to $40.92 billion.

The data elucidates a shift toward legal betting, albeit slowly. With stricter regulatory measures and increased awareness, the hope is that the illegal market will continue to recede. Nonetheless, the trend underscores a significant challenge for policymakers and legal operators alike.

Yield Sec’s findings are crucial for understanding the dynamic and often covert world of online gambling. As the legal market continues to expand, understanding the mechanics of the black market is essential for developing strategies aimed at curbing illegal activities. The statistics indicate that substantial efforts are still needed to shift bettors from illegal to legal platforms definitively.

The report sheds light on several other aspects of the US gambling landscape. For instance, it highlights the rising popularity of parlay bets, which indicates a trend towards more complex and potentially higher-reward gambling products. Furthermore, the data points to basketball as the sport generating the most legal GGR, followed closely by football and baseball. This insight could help legal operators tailor their marketing strategies to capture more of the market share.

In conclusion, while legal sports betting in the US has made impressive gains, the illegal market continues to pose a formidable challenge. Yield Sec’s report underscores the necessity for ongoing vigilance, innovative regulatory approaches, and public awareness campaigns to ensure a fair and legal gambling environment for all. As the landscape evolves, the battle between legal and illegal betting operations is far from over, highlighting the need for continued efforts to sway bettors toward regulated platforms.